Table of Contents

Hamilton Property Essentials

What This Guide Covers

This local guide helps landlords, tenants and investors understand key timelines and payment methods for owning and operating property in Hamilton, Ontario. It explains municipal interim and final tax bill timing, describes how to pay taxes through an online municipal portal, pre‑authorized debit, mail or in‑person, and shows how Found Spaces reduces compliance risk through coordinated maintenance and lease management. For readers who meant Hamilton County, Ohio, we clarify that county schedules differ and should be checked with the local treasurer. If you manage rental homes or a larger portfolio, use this as a practical checklist to align rent collection, PAD enrollment and lease clauses to avoid arrears and penalties. This guide connects local tax answers with Found Spaces services and next steps.

Hamilton Area Snapshot

Local Market And Tax Timing

Hamilton’s rental market remains strong with tight vacancy and steady demand across neighbourhoods such as Ancaster, the Mountain and Stoney Creek; competitive rents and near‑zero vacancy make professional management a practical choice for predictable returns. The City of Hamilton generally issues an interim tax bill in early February (installments due at the end of February and the last business day of April) and a final bill in early June (installments due end of June and end of September), with late payment penalties and interest applied when balances remain outstanding. Landlords managing multi‑unit holdings should confirm exact dates with the municipal calendar each year and consult municipal pages for penalty rates and any postal‑delay notices.

Found Spaces recommends aligning rent collection cycles with municipal due dates, and keeping the tax roll number handy for online account setup.

Found Spaces Services In Hamilton

Local Property Management Offerings

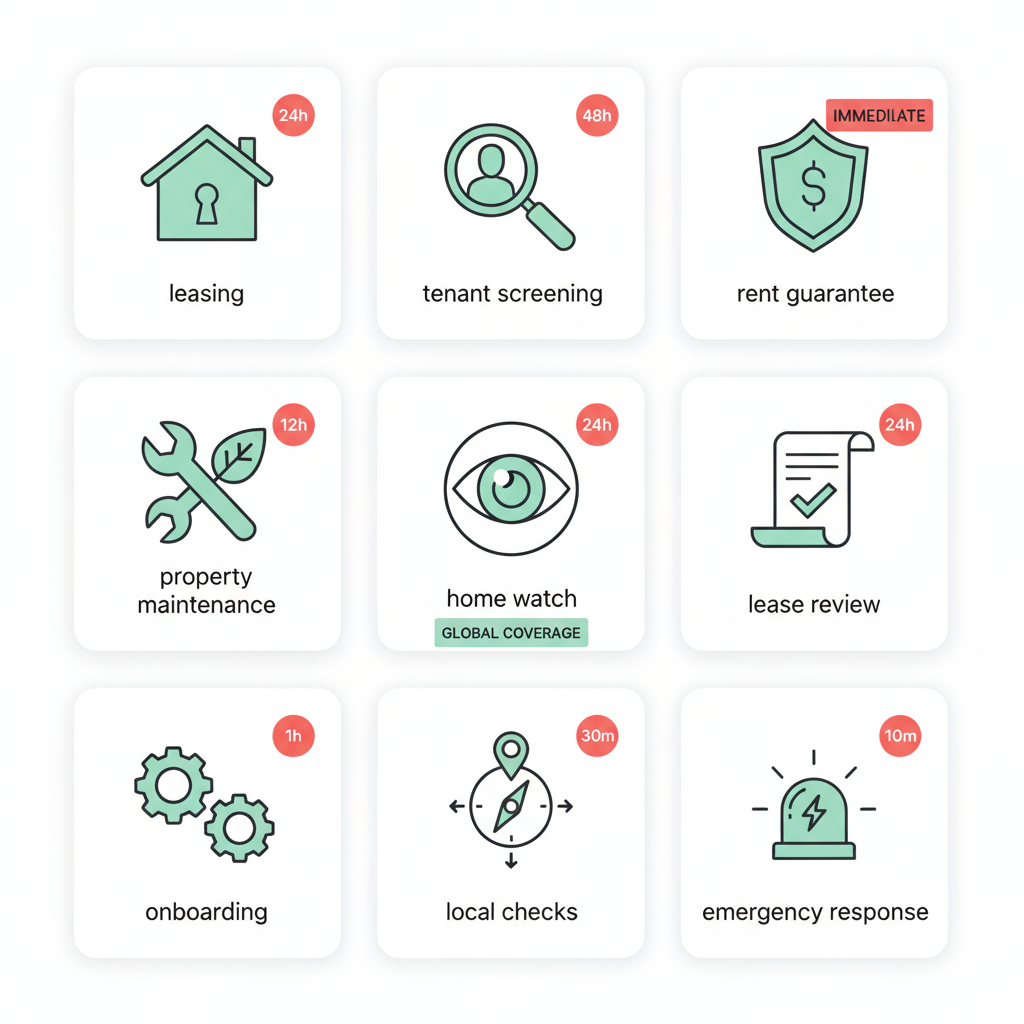

Found Spaces provides full‑service solutions across Hamilton and nearby markets to reduce owner workload and improve net operating income. Our team handles leasing and listing support with professional advertising, rigorous tenant screening and lease execution, and ongoing rent collection. We coordinate repairs through our in‑house maintenance teams and vetted vendors to control costs and speed response. Our rent guarantee options and tenant guarantees protect cash flow while our home watch program safeguards vacant homes. For more on availability, pricing and geographic coverage, check local pages and request a consultation to confirm service levels in your neighbourhoods.

Found Spaces service highlights and response time overview.

Tax And Tenant Considerations

Paying Taxes And Assessments

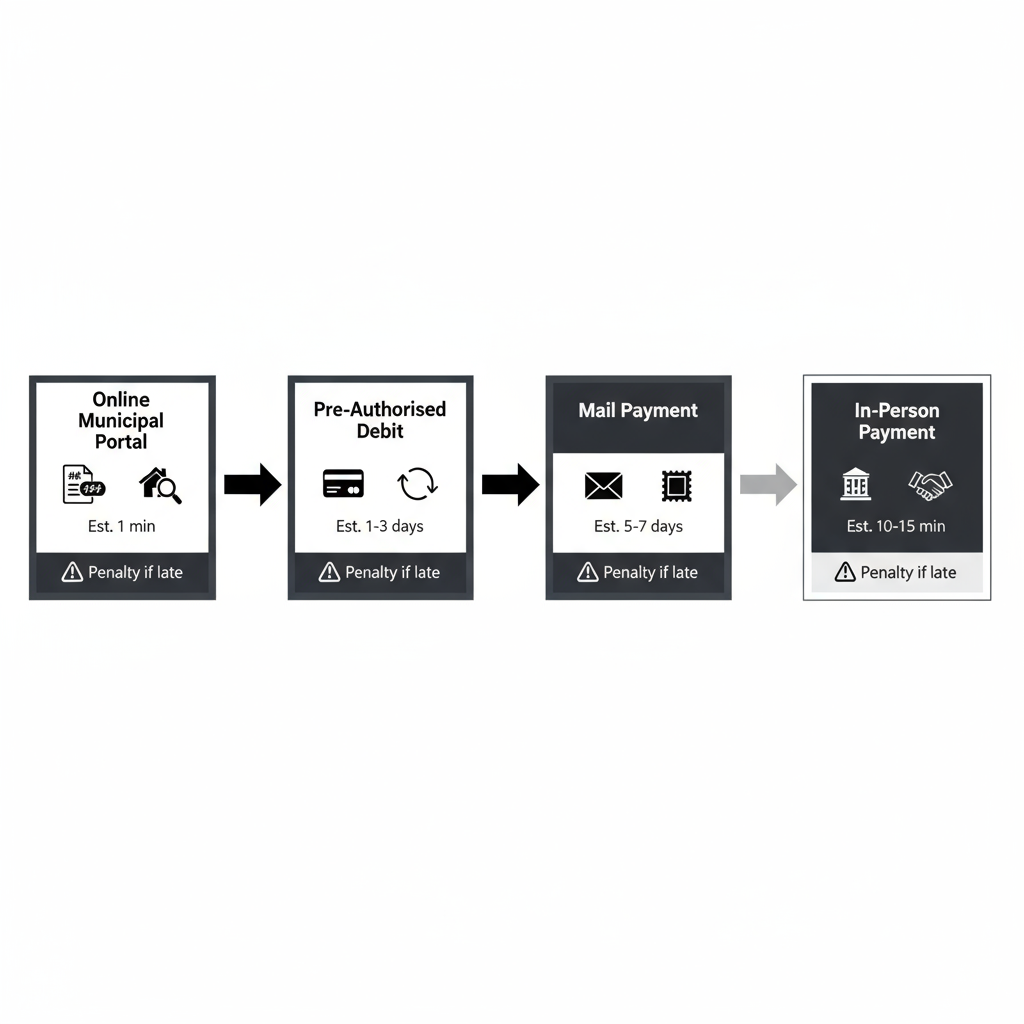

How much is property tax in Hamilton depends on your MPAC assessment multiplied by municipal tax rates; assessments determine the taxable value and changes to assessed value can raise or lower a bill. To pay, use the City of Hamilton’s online portal, enroll in Pre‑Authorized Debit for predictable monthly withdrawals, send payment by mail with your roll number, or pay in person at municipal service counters or participating banks. Pre‑authorized debit smooths cash flow and reduces missed payments while eBilling simplifies record keeping. Landlords should specify tax‑related responsibilities in the lease agreement where legally appropriate and maintain records of tax receipts to avoid disputes.

Four easy methods to pay Hamilton property taxes with key requirements.

Found Spaces helps owners enroll accounts, coordinate arrears prevention and include clear lease clauses to align tenant obligations with municipal charge responsibilities.

Start With Found Spaces

Onboarding And Compliance Steps

Begin with a short checklist: verify the MPAC assessment and property roll number, confirm municipal bill issue and due dates for the current year, set up PAD or online payments to match your rent cycles, and include property tax clauses in new lease agreements where appropriate. Found Spaces’ onboarding also includes a property condition inspection, integration into our online landlord portal for real‑time maintenance and financial reporting, and an outline of rent guarantee and tenant replacement protections. Our Acceler8 Tenant Audit system reduces placement risk and supports fast leasing, while home watch and coordinated maintenance reduce vacancy and damage exposure. Schedule a free consultation to map your onboarding timeline and confirm coverage for your specific Hamilton neighbourhood.

Next Steps For Landlords

Contact And Next Actions

Confirm municipal calendars annually, set up reliable payment methods such as PAD or the online municipal portal, and include clear tax clauses in the lease agreement to reduce disputes. For tailored support with leasing, maintenance, or rent guarantee options, contact Found Spaces to schedule a free consultation and confirm service coverage for your property.

For portfolio owners and landlords seeking hands‑on management in Hamilton, consider these actions: review assessment notices, align rent schedules with tax installments, and book a consultation to explore guarantees and maintenance coordination with Found Spaces.