Table of Contents

Understanding Commercial Property Management

What Commercial Management Means

Commercial property management refers to the professional oversight and direction of business assets such as office buildings, retail plazas, and industrial sites. Its primary goal is to preserve and increase the value of these investments through focused property maintenance, lease administration, tenant relations, and robust financial management. For owners and investors, especially in markets like Hamilton, Ontario, commercial management is critical to achieving reliable income streams and sustained portfolio growth. Unlike residential management, commercial management property involves navigating complex lease structures, detailed maintenance coordination, and sector-specific regulations that protect owners while supporting business tenants. Professional managers are essential for maximizing returns and preventing costly operational risks, making this expertise invaluable for owners intent on long-term success.

Who Uses These Services

A diverse range of stakeholders rely on commercial management services. These typically include property owners seeking passive income, real estate investors aiming for risk mitigation and capital appreciation, and organizations that occupy managed buildings. Hybrid landlords, who may own both residential and commercial assets, also benefit from integrated management strategies. Ultimately, both tenants–who require responsive services–and owners–who seek efficiency and compliance–are supported by the comprehensive solutions delivered through professional property management.

Foundspaces Local Context

Locally in Hamilton, Found Spaces stands out with its focus on commercial property management solutions tailored to the needs of area owners, investors, and tenants. The platform offers streamlined leasing, transparent operations, legal support, and advanced technology to simplify ownership and help commercial landlords thrive in the Greater Hamilton market. Learn more about their services at commercial property management hamilton.

Commercial Property Types Comparison Table

| Property Type | Typical Tenants | Management Focus |

|---|---|---|

| Office Buildings | Law firms, consultancies, startups | Lease negotiation, HVAC/elevator maintenance, amenities |

| Retail/Strip Malls | Retail chains, restaurants | Common area care, signage, parking, CAM reconciliation |

| Industrial/Warehouse | Fulfillment, logistics | Maintenance, zoning, loading area operations |

Commercial Management Fundamentals

Core Responsibilities

At its heart, commercial management property involves a suite of daily and strategic responsibilities aimed at maintaining smooth property operations. Key duties include prompt rent collection, proactive property upkeep, vendor management, and risk management to ensure regulatory compliance. Managers handle tenant communications, resolve disputes, and uphold building safety, while also providing owners with clear, actionable financial reporting. Regular asset inspections and budget preparation contribute to asset longevity and consistent returns. By taking a hands-on, responsive approach, managers act as strategic partners–protecting investments and ensuring the property’s financial and operational objectives are consistently achieved.

Services Overview

Commercial management property services are broad and highly specialized. Full-service providers offer leasing, tenant screening, emergency response planning, security coordination, and ongoing bookkeeping. Services often include:

- Lease negotiation and administration

- CAM (Common Area Maintenance) reconciliation for fair expense allocation

- Routine and emergency repairs

- Vendor tendering and oversight

- Legal support and documentation

- Advanced maintenance scheduling

- Digital portals for owner and tenant communication

Owners can also request tailored, a la carte solutions–choosing only the components needed for their unique portfolio or operational context. This enables targeted cost control and flexibility, especially for hybrid landlords and those with internal property teams.

Regulatory Basics Ontario

In Ontario, legal compliance is paramount for owners and property managers. Commercial tenancy falls primarily under contract law, with fewer statutory protections versus residential leases. However, all managers must ensure buildings comply with safety codes, zoning, accessibility standards, and relevant municipal licensing rules. Effective managers are well-versed in lease drafting, dispute resolution, and documentation requirements, helping owners mitigate legal risks. While residential management is governed by the Residential Tenancies Act, commercial properties rely heavily on the terms negotiated in each individual lease, making professional oversight indispensable.

Commercial Manager Service Types Comparison Table

| Service Model | Typical Inclusions | Best For |

|---|---|---|

| Full-Service Management | Leasing, maintenance, accounting | Passive investors |

| A La Carte Services | Lease support, billing, specific projects | Owners with internal teams |

| Hybrid Management | Mix of owner and vendor tasks | Hybrid landlords (res & comm) |

Operational Deep Dive

Maintenance And Repairs

Maintenance in commercial management property is both preventive and strategic. Preventive actions–like routine inspections–are essential for preserving building systems and reducing unexpected costs. Predictive maintenance, leveraging sensors and data, enables proactive interventions, while reactive approaches address issues as they arise. The choice of maintenance strategy directly impacts operational uptime, tenant satisfaction, and overall asset longevity. Found Spaces emphasizes standardized vendor vetting and regional expertise, addressing unique local challenges such as Hamilton’s weather or specific building codes. Maintenance logs, digital work orders, and transparent cost tracking provide owners with full visibility and control over ongoing expenses.

Lease And Finance Management

Lease administration is a cornerstone of successful commercial property management. Managers oversee complex lease terms–often including net, triple-net, or percentage-based agreements–while monitoring rent rolls and handling arrears. Finance management incorporates accurate budgeting, detailed reporting, and timely CAM reconciliations. Automated rent collection and digital portals support streamlined operations, while expert teams ensure legal obligations are always met. This financial discipline not only secures consistent revenue but also fosters positive tenant relationships and long-term investment growth.

Vendor And Risk Management

Vendor selection and risk mitigation are critical in minimizing liability for owners and ensuring regulatory compliance. Property managers in Ontario rigorously vet contractors, establish clear protocols for emergency response, and maintain robust insurance coverage. Occupational Health and Safety Act (OHSA) standards are closely adhered to, and managers proactively develop emergency plans for unforeseen events. Open lines of communication and regular staff training further reduce operational risk, creating safer, more resilient environments for all building users.

Commercial property management lifecycle: from leasing to reporting.

Maintenance Strategies Comparison Table

| Approach | Cost Profile | Operational Impact |

|---|---|---|

| Preventive Maintenance | Predictable costs, lower repair risk | Less downtime, needs scheduling |

| Predictive Maintenance | Higher upfront cost, long-term savings | High uptime, requires tech infrastructure |

| Reactive Maintenance | Variable, risk of emergency expenses | Unplanned downtime, tenant disruption risk |

Practical Management Guidance

Cost Structures And Fees

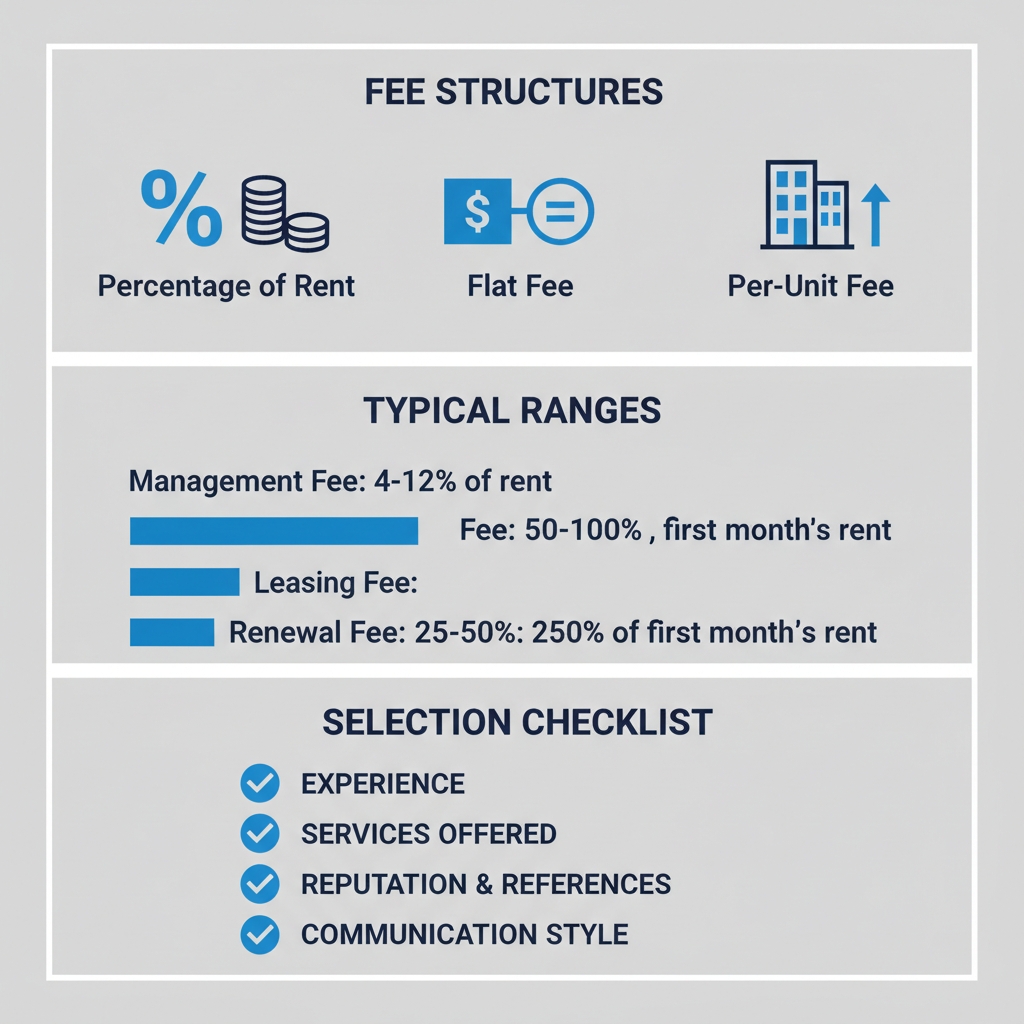

Commercial property management fees are structured in several ways, each catering to different owner needs and property types:

- Percentage of rent: Typically between 3-10% of collected rent for commercial, aligning manager incentives with occupancy and revenue.

- Flat monthly fees: Provide stable budgeting but may not adjust for varying workload.

- Leasing and project fees: One-time payments for tenant placements or capital project coordination.

The favored fee model will depend on the scope of services needed and the owner’s operational philosophy. Fee transparency and clearly documented terms are critical–owners should always review management agreements for hidden or ancillary charges.

Selecting A Provider Checklist

Choosing the right commercial manager is vital. A detailed checklist includes: verifying licensing and insurance, assessing experience with your property type, reviewing references, evaluating proposed service and reporting protocols, and ensuring clear, ongoing communication. Found Spaces, as a recognized leader in Hamilton, exemplifies these qualities, combining local expertise with digital tools for real-time tracking and problem resolution. Owners should also pay attention to service guarantees, such as Found Spaces’ signed lease pledge and satisfaction policies, which demonstrate accountability and client-focused operations.

Onboarding And Preparation

Efficient onboarding lays the groundwork for successful management. Owners should gather property documentation–leases, contracts, maintenance history–and provide clarity around property goals and any existing challenges. Scheduling a comprehensive condition audit is a best practice, as is communicating transition details to existing tenants. This methodical approach ensures nothing is overlooked and allows the manager to deliver immediate value from day one.

Guide to understanding property management fees and selecting the right provider.

Fee Models Comparison Table

| Fee Model | How It Works | Pros And Cons |

|---|---|---|

| Percentage Of Rent | Fee tied to collections | Scales with revenue, may shift incentives |

| Flat Monthly Fee | Fixed charge, stable billing | Predictable, can under-serve needs |

| Leasing/Project Fee | Paid per lease-up or major initiative | Aligns interests but increases upfront |

Advanced Management Considerations

Portfolio Optimization

Smart owners and managers continually analyze asset performance, tenant mix, and market trends to maximize net operating income and property value. This may involve repositioning properties, strategic renovations, or divestment decisions to strengthen the portfolio. Proactive lease restructuring and operational cost control are key levers for driving returns while maintaining flexibility in response to market dynamics.

Technology And Reporting

Modern commercial management property platforms rely on advanced reporting dashboards, KPIs, and digital portals to support proactive maintenance and enhance transparency. Automated rent collection, real-time budget tracking, and integrated communications foster trust among stakeholders. With Found Spaces, owners benefit from end-to-end digital management, ensuring timely insights and fast issue resolution–reinforcing confidence and control at every stage of the investment lifecycle.

Commercial vs Residential Management Comparison Table

| Topic | Commercial Management | Residential Management |

|---|---|---|

| Lease Structure | Negotiated, often net/triple-net, customized | Standardized tenancies, regulated rents |

| Regulation | Contract-based, fewer tenant protections | Governed by tenancy acts, more rules |

| Service Delivery | Complex systems, vendor-heavy, technical | Turnovers, emergency repairs, tenant screening |

Frequently Asked Questions

Key Quick Answers

What Is Commercial Property Management?

Managing operations, leasing, maintenance, and finances for commercial assets. See Commercial Management Fundamentals.

How Much Does It Cost?

Fees vary: percentage, flat, project-based. Typically, 3-10% of rent or flat fees; see Practical Management Guidance.

How Is It Different From Residential Management?

Commercial uses contract law, technical operations, and less regulation. Details under Advanced Management Considerations.

PAA Quick Answer Matrix

| Question | Short Answer | Section |

|---|---|---|

| What Is Commercial Property Management? | Operational and strategic oversight | Commercial Management Fundamentals |

| How Much Does It Cost? | Typically 3-10% or flat/project fees | Practical Management Guidance |

| How Different From Residential? | Lease/contracts, service delivery, regulations | Advanced Management Considerations |

Final Recommendations

Next Actions For Owners

Begin by auditing your current property management strategy and collecting necessary documentation. Shortlist reputable providers–preferably those specializing in commercial property management hamilton–and request detailed proposals. Preparing for onboarding with organized records and clear objectives will smooth the transition and amplify future returns.

Where To Learn More

For further insight or to compare local management options, request a consultation or compare local commercial management options in Hamilton with Foundspaces. Owners seeking broader regional insights can also explore property management companies in kitchener waterloo, supporting their investment journey with proven expertise.

Resources

Typical Commercial Property Management Fees — Esquire

Understanding Commercial Real Estate Asset Management — Primior

Foundspaces: Commercial Management Property

Foundspaces: Hamilton Property Management Services

Foundspaces: Property Maintenance Hamilton

Foundspaces: Ontario Landlord and Tenant Rights

Foundspaces: Commercial Property Management Hamilton